About

Your gift enables St. Paul’s to deliver world-leading care, research and medical teaching that benefits people throughout British Columbia and around the world.

Forms

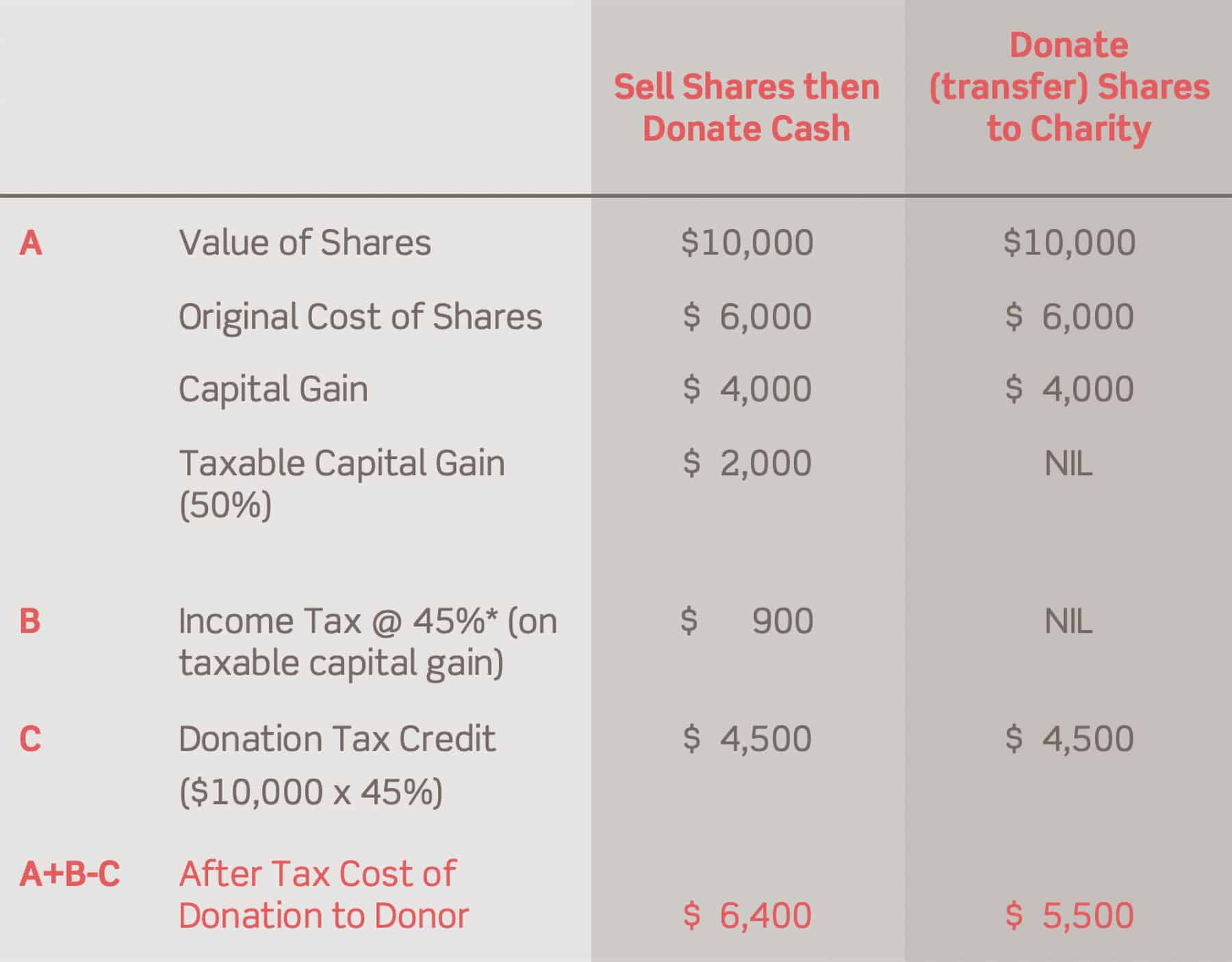

If you plan to make a charitable donation this year and you are the owner of publicly traded securities with accrued capital gains, you may wish to use those securities to make your gift. A gift of appreciated securities is a tax-efficient way to make a charitable donation and you may be able to make a larger gift than you thought possible.

The tax benefits of transferring publicly traded securities to a registered charity, like St. Paul’s Foundation, include:

- Elimination of the capital gains tax which would otherwise be payable if the securities were sold; and

- A charitable tax receipt issued to the donor for the full market value of the securities (determined on the day the securities are received by the Foundation).

In order to receive the tax benefits of donating appreciated securities, the securities must be transferred from the individual, estate or corporation to a registered charity such as St. Paul’s Foundation. Selling the securities, and then making a charitable donation of the sale proceeds, will not result in the elimination of the capital gains tax.

Securities which may be transferred to a registered charity include: shares, bonds, warrants, debentures, and mutual fund units or shares. (There are special rules and timing considerations which apply to donations of stock options and professional advice should be sought.)

Consider the following illustration: Jennifer Black owns shares in a major Canadian bank. She is taxed at the rate of 45% and has already made other donations of at least $200 in the current year.

What to do next

Contact your broker or investment advisor to review your investments. Securities which contain the largest accrued capital gains are likely the best candidates for your donation.

Most securities are held electronically and can be transferred easily from your brokerage account to the Foundation’s account. Please contact our office to obtain the form (see contact details below) or download and print the appropriate transfer form.

Please note that we have different forms for gifts of securities and stocks and for gifts of mutual funds.

It is important that your broker receive the completed and signed transfer form in order to initiate the transfer process. St. Paul’s Foundation must also receive a faxed or scanned copy to enable us to instruct our broker to accept the transferred investments.

Please contact us to learn more.

While we are not able to provide legal or accounting advice to individuals or others who are contemplating a charitable gift of appreciated securities, we welcome an opportunity to discuss your philanthropic intentions for your gift and to provide additional information about PHC and St. Paul’s Foundation.

Thank you for considering a gift to help support St. Paul’s!

For additional information, please contact: